Financial Transparency With Multiple Partners

Managing money in a life with several partners can feel like juggling plates while riding a unicycle. Yet in a well run hierarchical polyamory setup you can build trust and reduce stress by making money matters clear and predictable. This guide walks you through practical steps to stay fair practical and sane when money touches more than one heart. We explain terms so you never get stranded in jargon and we share real world scenarios you can adapt to your own life.

Quick Links to Useful Sections

- What this article covers

- Understanding the key terms

- Why financial transparency matters in hierarchical polyamory

- What to avoid

- How to set up a practical framework for money across multiple partners

- 1. Name the relationships and the financial expectations

- 2. Decide on a transparency level

- 3. Choose a financial structure

- 4. Set boundaries and must no s

- 5. Create a living budget for shared costs

- 6. Implement a system for expense tracking

- 7. Have regular check in meetings

- Practical structures for a household with a primary and multiple partners

- Structure A proportional contribution with a household pool

- Structure B split but with a clear primary focus

- Examples of common scenarios and how to handle them

- Scenario 1 A primary partner pays most of the shared housing costs

- Scenario 2 A secondary partner moves in and you adjust the budget

- Scenario 3 A partner has debt from past relationships

- Scenario 4 A partner wants a big upgrade or premium experience

- Scenario 5 A partner earns less or has irregular income

- How to talk about money with care and clarity

- Templates you can adapt for your dynamic

- Template A A starting joint budget note

- Template B A debt and repayment plan

- Template C A discretionary spending clause

- Privacy boundaries and transparency ethics

- Practical tools and resources

- Common questions and responses you can use

- Safety net checklists

- Glossary of useful terms and acronyms

- Frequently asked questions

- Putting it all together a step by step plan

- Final thoughts

- Checklist before you step into a money meeting

What this article covers

This guide is for people living in ethical non monogamy in a hierarchical polyamory dynamic. If you are new to the idea of ENM or you already live the dynamic and want better financial clarity you are in the right place. By the end you will have a simple framework for transparency. You will also have templates and talking points that make it easier to discuss money with all partners involved.

Understanding the key terms

Before we dive in here is a short glossary to remove guesswork. We keep definitions practical and aligned with real life. You will notice we spell out acronyms because that helps everyone stay on the same page.

- ENM Ethical non monogamy. A term used to describe relationships that involve more than two people with consent and honesty at the center.

- Hierarchical polyamory A form of polyamory where there is a primary partner or a core couple and other partners with different levels of involvement and priority. Finances often reflect these levels.

- Primary partner The person or people who hold the most central position in your life. They may share living space and major decisions including money related ones.

- Secondary partner Partners who are important but not in the top tier of priority. Their needs and expenses are recognized but may be handled differently than those of a primary partner.

- Budget A plan for how money will be earned spent saved and invested over a given period.

- Expense tracking A system for recording every cost so you can see where money goes and adjust as needed.

- Transparency Open sharing of financial information with the people who will be affected by the money decisions.

- Consent Agreement from all involved partners that money related rules will be followed as described.

- Budgeting framework A method such as proportional sharing or fixed contributions that aligns with relationship priorities and living realities.

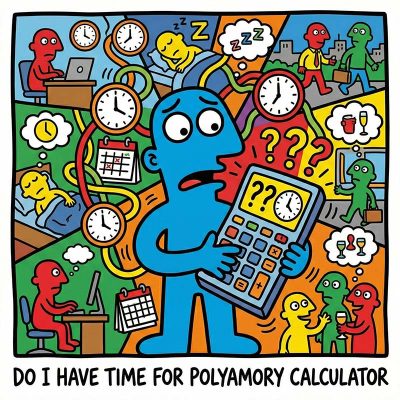

Love is infinite, but your calendar is brutally finite. The fantasy is deep connection; the reality is often just exhausted "calendar tetris." Promising time you don't actually have isn't romantic, it’s a recipe for burnout and broken trust. That sinking feeling when you have to cancel again? That’s the sound of overextension destroying your relationships.

This calculator forces you to confront the math of your life. Do you actually have space for another heart, or are you just setting everyone up for disappointment?

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

The ideal is pure equality. The reality? It often slides into hidden rankings where someone gets hurt. That sinking feeling that you are secretly a "secondary" despite the label? That is your intuition detecting couple privilege. Ambiguity is where resentment thrives.

The Essential Guide replaces vague promises with concrete governance. We provide the charters, equity tools, and jealousy protocols needed to ensure "non-hierarchical" isn't just a fantasy. Stop guessing who matters most. Build a network that is actually fair.

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

Why financial transparency matters in hierarchical polyamory

Money has a powerful influence on time energy and stress. When multiple partners are involved it is easy for hidden debt unexpected costs and unclear sharing to create resentment. A transparent approach does not mean sharing every last dollar with every person all the time. It means agreeing on what should be shared what should stay private and how to handle shared costs in a way that reflects each relationship's status. The goal is not to level every relationship down to the same number. The goal is to create fairness clarity and predictability so you can focus on connection not confusion.

What to avoid

Two big traps to avoid in hierarchical polyamory finances are secrecy and coercion. Never hide debt pretend to have income you do not have or force someone to share more than they are comfortable with. Also avoid letting money become a weapon in the dynamic. If a partner leverages money to control another person that is a red flag and should be addressed immediately with clear boundaries and possibly outside help.

How to set up a practical framework for money across multiple partners

Think about money in terms of relationships living arrangements and shared goals. A simple framework can reduce friction. Here is a practical approach you can adopt or adapt.

1. Name the relationships and the financial expectations

Start with a clear map of who is involved and what the money expectations are for each relationship. For example you might have a primary partner with shared housing and major bills and a secondary partner who shares occasional rent or contributes to occasional joint activities. Write down who pays what and when. The aim is to avoid surprises while keeping individual autonomy intact.

2. Decide on a transparency level

Transparency is a spectrum. In many hierarchical polyamory setups a good default is that major ongoing costs are visible to all involved parties. Personal discretionary spending can be private as long as it does not affect shared financial stability. Agreements should specify what is shared and what stays private so there is no guesswork.

3. Choose a financial structure

Options include separate accounts for each partner combined with a household account or a shared pool of money for joint expenses. In some dynamics all partners contribute to a central fund in proportion to income or to a defined formula. The important part is to document the structure so everyone knows how the money flows and who is responsible for which expenses.

4. Set boundaries and must no s

Be clear about boundaries around debt and leverage. You may want rules about borrowing from partners leaving room for grace but also clear expectations about repayment and interest or not. Define what counts as a shared expense and what counts as a personal expense. Put it in writing so everyone can reference it later.

5. Create a living budget for shared costs

List everything that affects the shared household such as rent mortgage utilities groceries household supplies and any shared activities. Decide the share for each partner based on the agreed framework. Make room for future changes because relationships evolve and so do finances.

6. Implement a system for expense tracking

Use a simple shared tool such as a spreadsheet or a budgeting app. The goal is not to micromanage but to avoid blind spots. Track recurring costs clearly and tag each expense with the responsible relationship. Review the tracker regularly with all involved parties.

7. Have regular check in meetings

Schedule a monthly or quarterly money check in. Use this time to review the budget discuss changes and adjust the framework as needed. Regular communication helps reduce anxiety and builds trust over time.

Practical structures for a household with a primary and multiple partners

Every dynamic is unique. Below are two common approaches that work for many hierarchical polyamory setups. Adapt them to fit your life and your values.

Structure A proportional contribution with a household pool

In this structure each partner contributes to a central pool that covers all household costs. The size of the contribution is based on income or a pre agreed formula. The primary partner may choose to keep a larger share of discretionary income. The household pool covers rent mortgage utilities groceries cleaning supplies and shared services. Each partner can still have personal accounts for personal spending and savings.

Structure B split but with a clear primary focus

The primary partner takes ultimate financial responsibility for major household expenses and any shared assets such as a car or home improvement. Secondary partners contribute to specific categories such as groceries or utilities or a portion of rent if they share living space. Personal expenditures remain private. The key is to document who pays for what and to review every few months to avoid drift.

Examples of common scenarios and how to handle them

Scenario 1 A primary partner pays most of the shared housing costs

Alex the primary partner earns more and covers most of the living costs including rent and mortgage plus some utilities. A secondary partner pays a fixed amount toward groceries and shares in occasional household maintenance. A third partner contributes to recreational expenses when they join in a weekend away. Transparency means all are aware of the total monthly housing costs and how each person contributes. If someone misses a payment the group discusses how to cover the shortfall without blame and with a plan to prevent repeat issues.

Scenario 2 A secondary partner moves in and you adjust the budget

A new partner joins who will be sharing living space and contributing to utilities. The group revisits the household budget and adjusts proportions. They create a one time welcome fund to cover initial setup costs such as household items and groceries for the first month. Everyone agrees to update the plan within the first thirty days and then again every quarter until stability is reached.

Scenario 3 A partner has debt from past relationships

Debt happens. In a transparent framework it is essential to discuss how past debt affects present capacity. The group decides whether to treat debt as a personal obligation or to include it in a shared plan to be repaid over time. A realistic approach includes a repayment schedule and a clear boundary about future borrowing and how it may affect future shared expenses.

Scenario 4 A partner wants a big upgrade or premium experience

Sometimes a partner wants to upgrade living arrangements or plans for a shared experience such as a trip. The group discusses how much can be allocated to discretionary experiences without compromising essential expenses. If the budget can accommodate it the cost is shared as a specific line item with a defined time frame and a clear exit plan if the experience does not meet expectations.

Scenario 5 A partner earns less or has irregular income

Income variability happens. The group adapts by creating a flexible budget that adjusts contributions based on income. The aim is to keep fairness while maintaining security for essential costs. In such cases a buffer or emergency fund becomes especially important and the group agrees to contribute to it together.

Love is infinite, but your calendar is brutally finite. The fantasy is deep connection; the reality is often just exhausted "calendar tetris." Promising time you don't actually have isn't romantic, it’s a recipe for burnout and broken trust. That sinking feeling when you have to cancel again? That’s the sound of overextension destroying your relationships.

This calculator forces you to confront the math of your life. Do you actually have space for another heart, or are you just setting everyone up for disappointment?

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

The ideal is pure equality. The reality? It often slides into hidden rankings where someone gets hurt. That sinking feeling that you are secretly a "secondary" despite the label? That is your intuition detecting couple privilege. Ambiguity is where resentment thrives.

The Essential Guide replaces vague promises with concrete governance. We provide the charters, equity tools, and jealousy protocols needed to ensure "non-hierarchical" isn't just a fantasy. Stop guessing who matters most. Build a network that is actually fair.

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

How to talk about money with care and clarity

Conversations about money can be awkward especially in a multi partner setting. Here are practical communication tips to keep conversations constructive and kind.

- Use I statements Speak from your own experience and feelings rather than making accusations. For example I feel anxious when I cannot see how our shared funds are used rather than You never tell me anything.

- Focus on shared goals Tie money decisions to living arrangements and relationship health. Remind everyone that money is a tool that enables more time together not a control instrument.

- Document agreements Put decisions in writing. All parties should have access to the same document so there is no misinterpretation later.

- Agree on a check in cadence Regularly revisit the plan and adjust as life changes. Consistency reduces anxiety about uncertainty.

- Empathize with different circumstances People contribute in different ways whether through time energy or money. Honor each form of contribution and avoid shaming any single mode of participation.

Templates you can adapt for your dynamic

Use these templates as starting points. Personalize them to reflect your own relationships values and living situation. Keeping language clear and concrete helps everyone stay aligned and reduces friction during busy times.

Template A A starting joint budget note

We the people in this shared life including [Partner A] [Partner B] and [Partner C] agree on these basics. We have a household budget that covers rent utilities groceries household supplies and shared activities. Each month contributions are calculated based on income and living arrangements. The primary partner will cover the major fixed costs while others contribute according to agreed percentages. Personal expenses remain private unless we opt to share for a specific purpose. We review this plan on the first of every month and adjust as needed.

Template B A debt and repayment plan

When debt from any partner affects the group we agree to a repayment plan. The person in debt will share the amount and the expected payoff schedule. The rest of the group commits to supporting the plan as agreed. If a new debt arises the group meets to decide how to adjust the budget and whether to reallocate funds to accommodate changes. All terms remain subject to consent of those involved.

Template C A discretionary spending clause

Discretionary spending is allowed within limits. Each partner may spend up to [amount] each month without prior notice. Any amount above the limit must be discussed in a check in meeting. The goal is to maintain freedom while protecting shared finances against unexpected costs.

Privacy boundaries and transparency ethics

Transparency does not mean zero privacy. It means clear boundaries about what is shared and what stays private. A healthy policy might be to share about major recurring costs and any debt that affects the group while keeping individual shopping receipts private. Establish what triggers a broader disclosure such as large purchases or debt consolidation. Agree to respect those boundaries even during tense moments. Privacy boundaries help sustain trust especially when life becomes hectic.

Practical tools and resources

There are plenty of tools that can help you manage money across multiple partners without turning the process into a pile of stress. Here are some practical options to consider.

- Spreadsheets A simple monthly budget with columns for income expenses shared costs and personal spending. A shared folder allows all partners to review whenever they want.

- Budgeting apps Apps that allow multiple users to access a single budget or a series of budgets for different living arrangements. Look for features that support multi user access and notes from each partner.

- Expense tracking apps Apps that can tag expenses by partner and cost category. These are ideal for keeping a transparent record with minimal complexity.

- Document storage Use a single secure space for all agreements policies and revised plans. Make sure every partner has access and that changes are tracked.

- Money coaching If the numbers get unwieldy or emotions run high you may want a poly friendly financial coach or counselor who understands ENM and hierarchical polyamory dynamics.

Common questions and responses you can use

Here you will find quick answers to questions you may encounter. Use them as talking points when you are setting up your framework or when you revisit plans with your partners.

- Should we have a joint bank account A joint account can simplify shared costs but it is not required. Some groups use a household pool with a separate account plus personal accounts for private spending. The important thing is that all agree on the structure and that it is not used to trap or control anyone.

- How do we handle debt from one partner If debt is a factor create a repayment plan that is fair and does not deprive essential living costs. Document who is responsible for payments and how defaults are addressed.

- What if someone earns less Build a flexible plan where contributions scale with income. Also create a small emergency fund to handle slow periods without stressing the entire network.

- How do we handle big life events like moving in together Re evaluate your budget and decide how costs will be shared for the new life arrangement. Adjust the plan and set a specific timeline for when you will review again.

- What if there is disagreement Take a pause breathe and set a dedicated time to discuss with a neutral facilitator if needed. Focus on needs not blame and work toward a tangible compromise.

- Do we need a written agreement Yes a written agreement makes expectations clear reduces ambiguity and helps with accountability. Revisit and revise the agreement as life evolves.

- Should we track every expense Not every single receipt is necessary but a high level view of where money goes helps. Focus on recurring costs and major one time expenses that involve more than one partner.

- What about taxes and legal considerations Consult a professional to understand how multiple partners may affect taxes and any legal obligations especially if you share assets or dependents.

Safety net checklists

Use these quick lists to keep momentum and reduce risk as you implement or adjust your money framework.

- Before you start Agree on a time to talk. Define the scope of the discussion and commit to an honest conversation free from blame.

- During the conversation Listen actively repeat back what you heard and check for understanding. Write down any agreed actions and next steps.

- After the conversation Update the written plan and share it with everyone. Schedule the next review and set reminders in your calendar.

- Ongoing Practice transparency with kindness. If something changes update the plan promptly so trust stays strong.

Glossary of useful terms and acronyms

- ENM Ethical non monogamy a relationship style that invites multiple emotional and sexual connections with consent and honesty.

- Hierarchical polyamory A system with a primary partnership and other partners who have different statuses or levels of involvement.

- Primary partner The partner or partners given top priority in living arrangements and major decisions including money issues.

- Secondary partner Partners who are involved but do not share the same level of priority as the primary partner.

- Joint expenses Costs that are shared by two or more partners such as rent utilities groceries or shared activities.

- Expense tracking The practice of recording costs to maintain clarity and accountability.

- Budget A plan for how money will be earned spent saved and invested over a period.

- Consent based money rules Financial arrangements that all involved partners agree to ahead of time.

- Kitchen table polyamory A term for a style of polyamory where all partners are invited to the table for conversations and decisions about the relationship.

Frequently asked questions

How do we start a money conversation in a hierarchical polyamory setup

Set a calm time and choose a neutral place. Start with a shared goal such as reducing financial stress or making room for future plans. Use simple language and present a draft of the plan that you want feedback on. Invite every partner to share what matters most to them about money and life together.

Should we have a single budget or multiple budgets

Multiple budgets can work especially when living arrangements differ. A shared household budget keeps essential costs predictable while individual budgets maintain autonomy. The key is clarity about what is shared and what is private.

What if one partner does not want to disclose debt

Respect personal boundaries but explain how secrecy can undermine trust in the group. Offer a private space to share only what is necessary to manage shared costs and plans. If debt affects household stability you may need to address it in a formal plan with agreed repayment terms.

How often should we revisit the plan

For most groups a monthly check in and a quarterly review work well. Adjustments happen when life changes such as moving in together a new job a change in living arrangements or a shift in the number of partners involved.

Can we involve a professional in the process

Yes a poly friendly financial coach or a therapist who understands ENM can help mediate conversations and refine the plan. A professional can provide an objective view and help you craft agreements that stand the test of time.

How to handle big life events financially

For big events create a dedicated plan that outlines what costs will be shared how funds will be allocated and how soon those expenses will be paid back if applicable. Make sure everyone agrees and that there is a clear timeline to prevent drift.

Putting it all together a step by step plan

Here is a practical step by step plan you can start using this week. Adjust the timing to fit your life and your relationships.

- Block time for a money talk with all partners present. Prepare a simple outline and a draft budget.

- Agree on the level of transparency for the group. Decide what will be shared and what remains private.

- Choose a financial structure such as a household pool with a separate personal accounts or a joined account approach and document the choice.

- Build a household budget listing all fixed and variable costs. Decide how each partner contributes based on your chosen framework.

- Set up expense tracking in a shared tool. Include notes so partners can see the context behind each cost.

- Schedule a monthly check in to review the budget and adjust as life changes.

- Establish a plan for special events. Create a separate line in the budget for those events and agree on how funding will work.

- Agree on who will maintain the budget and how edits will be recorded. Ensure everyone has access to the latest version.

- Revisit and revise the plan at least every six months or when a major life change occurs.

- Celebrate the wins. A transparent and fair system makes space for more time and energy to invest in the relationships you care about.

Final thoughts

In a hierarchical polyamory setup money can be a pressure point or a bridge to deeper trust. The difference lies in how you talk about it and the plan you agree on together. When transparency is paired with fairness and consent your money becomes a tool that supports your lifestyle rather than a source of conflict. Keep the dialogue alive with regular check ins and be willing to adjust as life unfolds. The goal is to create stability so you can focus on growth connection and the kind of relationships that feel right for you and the people you choose to share life with.

Checklist before you step into a money meeting

- Clarify the scope of the conversation and the time you have.

- Prepare a simple draft budget with the main lines of shared costs and personal spending.

- Decide how you will track expenses whether with a spreadsheet an app or a combination.

- Agree on a transparency level and the boundaries around private spending.

- Set a date for the next check in and commit to reviewing the plan.

Love is infinite, but your calendar is brutally finite. The fantasy is deep connection; the reality is often just exhausted "calendar tetris." Promising time you don't actually have isn't romantic, it’s a recipe for burnout and broken trust. That sinking feeling when you have to cancel again? That’s the sound of overextension destroying your relationships.

This calculator forces you to confront the math of your life. Do you actually have space for another heart, or are you just setting everyone up for disappointment?

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

The ideal is pure equality. The reality? It often slides into hidden rankings where someone gets hurt. That sinking feeling that you are secretly a "secondary" despite the label? That is your intuition detecting couple privilege. Ambiguity is where resentment thrives.

The Essential Guide replaces vague promises with concrete governance. We provide the charters, equity tools, and jealousy protocols needed to ensure "non-hierarchical" isn't just a fantasy. Stop guessing who matters most. Build a network that is actually fair.

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.