Money and Resource Allocation Without Ranking

Welcome to a bold but practical guide on how to handle money and resources when you are practicing non hierarchical polyamory. We are talking about a world where love is not organized by a ladder or a pecking order but by consent, communication, and transparent agreements. If you are tired of money talk turning into drama at a dinner table that never ends, you are in the right place. This is a no judgement zone with real world tools you can put into action tonight. ENM stands for ethical non monogamy and non hierarchical polyamory means there is no top person who controls the purse strings or makes all the calls. Instead, partners contribute in ways that feel fair to them and to the life they share together. We will explain terms as we go so everyone can follow along no matter their background.

Quick Links to Useful Sections

- What non hierarchical polyamory means for money

- Core principles for fair money talk without ranking

- Equality vs equity and why both matter

- Must nots when talking money in a non hierarchical setup

- Practical allocation models you can use without ranking

- Model A: Equal baseline contributions with room for personal expense shares

- Model B: Proportional contributions based on income

- Model C: Shared pot for shared life with individual buffers

- Model D: Rotating budget categories

- Model E: Buffer and emergency fund first

- Money matters for housing and daily life

- Healthcare and insurance costs in a non hierarchical setup

- Finances and agreed boundaries around debt

- Time allocation and resource balance

- Practical tools and practices that support a non ranking system

- Communication frameworks that keep money matters healthy

- Realistic scenarios and how to handle them

- Scenario 1: Two partners living together with a third in a long distance arrangement

- Scenario 2: A partner enters the group and a temporary withdrawal from work occurs

- Scenario 3: New partner joins the dynamic

- Scenario 4: A partner wants significant discretionary spending for personal projects

- Scenario 5: A big life event requires a group funded investment

- Glossary of useful terms and acronyms

- Frequently asked questions

Think of this guide as your friendly experimental partner who loves a good plan, a little humor, and a lot of clarity. We will walk through definitions, must nos, practical models, realistic scenarios and concrete steps you can use to keep money from poisoning the vibe. And yes we will cover every angle from shared housing to debt to healthcare costs to fun splurges. The goal is simple build a system that respects autonomy while keeping the group thriving. No ranking. No gatekeeping. Just fair and practical money management in a dynamic where love multiplies when boundaries are clear.

What non hierarchical polyamory means for money

Before we dive into numbers, let us decode the core idea. In a traditional setup someone might be “in charge” of the finances or a hierarchy of partners is implied by how the relationship is described. In non hierarchical polyamory there is no formal ranking. Instead people come to agreements through open dialogue. The same idea applies to money. There is no single authority that decides how much each person pays or what gets funded. Instead partners negotiate based on shared goals, personal capacity, and the realities of lifestyle choices. This approach reduces power imbalances and creates space for everyone to contribute in ways that make sense for them. It also means you can adapt as life changes whether someone changes jobs or a family growing scenario shifts daily schedules. We will break down how to implement this in a practical way.

Key terminology we will use often in this guide includes ENM short for ethical non monogamy and CNM short for consensual non monogamy. When we say non hierarchical we mean a structure without a single lead partner compiling the budget or deciding who pays for what. It is all negotiated as a team. A note on terminology is important because language shapes behavior. If you prefer the term “flat structure” or “horizontal model” you are not alone. The core idea is the same fairness without rank.

Core principles for fair money talk without ranking

- Consent first All financial decisions are discussed, agreed upon and revisited with the group. No one is forced into a plan.

- Transparency always Keep records accessible. Shared spreadsheets, budgets and receipts help reduce confusion and suspicion.

- Autonomy matters Each person can choose how much they contribute based on their own situation and we respect that choice.

- Fairness over equality Equality means everyone contributes the same amount. Fairness means contributions reflect capacity and life goals.

- Flexibility is a feature not a flaw Life changes. The system should adapt with honest updates rather than causing a break in trust.

- Practical boundaries Boundaries protect emotional safety and financial health. They prevent resentment from creeping in.

- Communication cadence Regular check ins keep the plan fresh and prevent drift. A monthly or quarterly money talk works well for most groups.

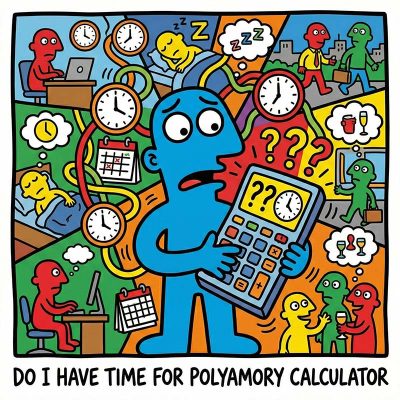

Love is infinite, but your calendar is brutally finite. The fantasy is deep connection; the reality is often just exhausted "calendar tetris." Promising time you don't actually have isn't romantic, it’s a recipe for burnout and broken trust. That sinking feeling when you have to cancel again? That’s the sound of overextension destroying your relationships.

This calculator forces you to confront the math of your life. Do you actually have space for another heart, or are you just setting everyone up for disappointment?

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

The ideal is pure equality. The reality? It often slides into hidden rankings where someone gets hurt. That sinking feeling that you are secretly a "secondary" despite the label? That is your intuition detecting couple privilege. Ambiguity is where resentment thrives.

The Essential Guide replaces vague promises with concrete governance. We provide the charters, equity tools, and jealousy protocols needed to ensure "non-hierarchical" isn't just a fantasy. Stop guessing who matters most. Build a network that is actually fair.

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

Equality vs equity and why both matter

You may hear people confuse equality with equity. In our world equality means everyone pays the same amount regardless of income. Equity means people contribute in proportion to what they can. In many polyamorous groups equity is the more realistic goal because incomes, expenses and life responsibilities vary. Here is a simple way to visualize it. If everyone has the same wallet size a fixed contribution makes sense. If someone earns more or has fewer expenses they may stretch further while someone with tighter finances contributes less. The outcome should feel fair to everyone involved and keep the relationship healthy. You can design a hybrid approach a sliding scale where basic living costs are shared proportionally while personal expenses stay with the individual. The main point is to decide together and to revisit often.

Must nots when talking money in a non hierarchical setup

- No secrecy If a partner has a debt or a substantial financial change it should be shared with the group in a timely way.

- No power plays Do not use money to manipulate emotions or limit access to the group. Decisions should be about shared life not control.

- No hidden costs Surprises in the budget lead to trust issues. If there is a possible expense say so and decide together.

- No shaming People come from different financial backgrounds. Do not mock a partner for spending choices that they can responsibly handle.

- No single point of failure Do not rely on one person to manage all money matters. Shared oversight reduces risk and friction.

Practical allocation models you can use without ranking

Model A: Equal baseline contributions with room for personal expense shares

This model uses a simple rule base to keep expenses predictable while honoring autonomy. Each person agrees to contribute a baseline amount toward shared living costs. That baseline is the same for all participants at first. Personal expenses like personal shopping or solo trips stay with the individual. If someone moves in or out or a new partner joins the group the baseline adjusts through a group decision. The key is to have a transparent calculation method so there is no guessing or late night budget drama. You can implement a transparent spreadsheet that shows all baseline numbers and individual line items.

Model B: Proportional contributions based on income

A more flexible system called proportional sharing uses income as the anchor. Each partner contributes a percentage of their take home pay toward the shared budget. For example the group could choose a 5 to 20 percent range depending on situation. A higher income contributor might cover more of the shared costs while still leaving room for personal finances. The important part is to agree on a percentage that feels fair and to adjust as income changes. This model reduces stress for partners who are navigating job loss career changes or pay freezes while preserving household stability.

Model C: Shared pot for shared life with individual buffers

In this approach partners contribute to a large shared fund that covers most joint expenses like rent utilities groceries and household supplies. Each person also keeps a personal buffer or reserve fund to protect their own finances. The shared pot is managed by a small rotating committee or a trusted neutral third party to avoid concentration of power. This model supports strong collaboration and makes it easier to fund joint goals such as travel or home improvements.

Model D: Rotating budget categories

This model uses a rotating ownership of budget categories so no one person becomes the de facto finance manager. Each month a different partner leads a specific budget area such as groceries housing or activities. The monthly lead is responsible for forecasting needs gathering receipts and reconciling the account. This approach keeps energy and attention evenly distributed and helps partners learn new skills while keeping the system fair and engaged.

Model E: Buffer and emergency fund first

Life happens and in polyamorous networks it can happen to multiple people at once. A clearly funded buffer fund reduces stress during tough times. Guidelines might include a minimum target equal to two to three months of shared living expenses. If someone falls behind or a partner faces an unexpected bill the buffer helps keep trust intact. Rebuild the buffer over time by allocating a portion of any windfalls or bonuses toward the fund until it is fully rebuilt.

Money matters for housing and daily life

Housing is often the biggest line item in any budget. For non hierarchical groups shared living arrangements require clear agreements. If you are all living together you may have a combined lease or separate leases. Either way ensure your plan covers rent or mortgage utilities internet maintenance and shared household supplies. A practical step is to maintain a shared ledger for recurring expenses and pair it with a personal ledger for individual expenses. You can also set a monthly check in to review the numbers and adjust for changes in occupancy and life events. If some partners are not living in the same home you can still share costs like groceries or weekly activities so the group dynamic remains cohesive.

Healthcare and insurance costs in a non hierarchical setup

Health insurance is not optional and neither is dental or vision coverage for many. In a non hierarchical polyamorous dynamic you should discuss who pays for coverage what happens if someone changes jobs and whether a partner can be added or removed from an insurance plan. Some groups maintain a shared health fund to cover co pays and minor medical expenses while others keep insurance held individually and share premium costs for convenience. The key is to agree on a policy that protects everyone and a process for how costs are shared or reimbursed when needed.

Finances and agreed boundaries around debt

Debt management is a sensitive area that can become a hot topic in any polyamorous circle. Decide how existing debt will be handled within the shared system. Some groups allow debt payments to become a shared responsibility while others prefer that debts stay with the person who incurred them or are paid from personal funds unless a joint benefit can be shown. Create rules that prevent debt from becoming a wedge between partners. If someone accrues new debt plan a regular review to assess risk and ensure there is a plan to meet obligations without sacrificing the group budget.

Time allocation and resource balance

Money is not the only resource. Time is a crucial factor in ethical non monogamy. You may want to track how much time each person spends on household tasks date nights household decisions or energy spent on group projects. A simple time budget can be created to balance energy and ensure no one feels overwhelmed. When one partner is working long hours or caring for family members you may choose to adjust contributions or shift responsibilities accordingly. Remember that fairness here means acknowledging effort not counting hours like a clock watcher. The goal is to prevent burnout and maintain a sustainable rhythm for everyone involved.

Practical tools and practices that support a non ranking system

- Shared ledger Use a simple cloud based spreadsheet with categories for Rent Utilities Groceries Shared Fun Travel and Medical. Update it monthly and keep receipts accessible.

- Clear ownership Designate people responsible for specific budget areas rather than a single budget boss. This reduces bottlenecks and keeps the group honest.

- Split wisely When certain expenses are personal or only relevant to some partners track those separately to avoid confusion and resentment.

- Scheduled reviews Have a calendar reminder for quarterly budget reviews and a separate annual planning session for long term goals like home upgrades or debt payoff strategies.

- Use automation Automate recurring payments to avoid late fees and to ensure transparency with clear labeling so everyone knows what is being paid and why.

Communication frameworks that keep money matters healthy

Communication is the backbone of any shared money plan. A few practical frameworks can keep conversations productive and civil even when emotions are high.

- Rituals Establish a predictable cadence for money talks such as a monthly 60 minute meeting plus a quarterly longer planning session.

- Ground rules Start with emotional safety rules like listen without interrupting and assume good intent. Use neutral language and avoid personal attacks.

- Decision making Use a consensus approach or a defined voting method for major decisions. If consensus is not reached a predefined tie breaking approach should exist.

- Conflict resolution Create a process for cooling off if conversations escalate. A pause and a follow up talk can save relationships and budgets.

Realistic scenarios and how to handle them

Scenario 1: Two partners living together with a third in a long distance arrangement

The core question is how to allocate costs fairly when not everyone shares a home. A practical approach is to split fixed costs in the shared home among the partners who live there based on income or a flat rate for each resident. The long distance partner contributes to shared expenses such as groceries for meals prepared together during visits or contributes to a shared travel fund for visits. The travel fund becomes a separate line item so the group can plan revenue and expenses around visits. It is important to ensure each person feels valued regardless of distance and to plan regular visits to keep relationships healthy as well as budgets stable.

Scenario 2: A partner enters the group and a temporary withdrawal from work occurs

When a partner experiences a pay cut or a temporary job gap the group can redraw the budget for a period. The partner with reduced income may contribute less while others step up to cover essential costs. It is crucial to have a defined grace period and a timeline for reassessment so the change does not become a permanent burden. In most cases the group agrees on a plan that preserves the life they share while respecting the needs of the partner who is temporarily out of work. This approach prevents resentment and keeps the system fair and humane.

Scenario 3: New partner joins the dynamic

Adding a new partner to a non hierarchical group is a moment to revisit the budget from basics. The group should discuss baseline costs associated with shared living and how the new person will contribute. Some groups use a probation budget period to ensure alignment and to avoid misalignment in values or expectations. It is essential to welcome new members with clear expectations about contributions and to provide the same information about the shared ledger so everyone is on the same page from day one.

Scenario 4: A partner wants significant discretionary spending for personal projects

Discretionary spending for personal projects can still be compatible with a non hierarchical budget. Create an approved discretionary fund with a defined cap and a process for approval such as a simple vote or a fast lane if the expenditure is under a certain amount. This approach protects the shared budget while giving freedom for personal growth or adventure and keeps trust intact by documenting decisions.

Scenario 5: A big life event requires a group funded investment

Whether it is a home purchase a dream trip or a business venture a big life event benefits from a formal plan. The group should agree on a target amount set a timeline and decide who contributes how much. If necessary a savings strategy can be put in place to reach the target without compromising day to day stability. The key is to be realistic about what can be achieved together and to break the goal into manageable milestones with regular progress updates.

Glossary of useful terms and acronyms

- ENM Ethical non monogamy a relationship framework that emphasizes consent honesty and ethical behavior in multiple romantic or sexual relationships.

- CNM Consensual non monogamy another widely used umbrella term for ethical non monogamy variations including non hierarchical models.

- Non hierarchical polyamory A polyamorous arrangement where there is no defined top partner or ranking in terms of authority or decision making including finances.

- Equity A fairness concept focusing on contributions that reflect capacity and life circumstances rather than equal shares for everyone.

- Equality A fairness concept where everyone contributes the same amount regardless of income or circumstance.

- Shared pot A central fund into which partners contribute for common living expenses and activities.

- Budget reconciliation The process of reviewing and adjusting budget items to reflect changing life situations.

- Burnout A state of physical or emotional exhaustion caused by excessive and prolonged stress especially around finances and household tasks.

- Disclosure The act of sharing important financial information with all relevant partners in a timely manner.

Frequently asked questions

What does non hierarchical polyamory mean for money management

It means there is no single person responsible for all money decisions. Instead agreements are created through open discussion and ongoing negotiation. All partners contribute based on capacity and the group uses transparent processes to manage expenses and savings for shared goals.

How do we start if we have many different incomes in the group

Start with a candid conversation about income ranges and financial goals. Decide on a model that fits your situation whether it is proportional contributions or a shared pot with personal buffers. Create a simple budget that covers essentials first and then plans for savings and fun. Revisit the model every few months to adjust as incomes or life circumstances change.

Is equality or equity better for our budget

Most groups choose equity as the guiding principle because it aligns with real world differences in income and life responsibilities. You can still incorporate equality for certain categories if it makes sense and keep the overall plan fair by measuring contributions against capacity.

What if someone cannot contribute due to illness or job loss

Equity based approaches make room for temporary adjustments. The group can reduce the share from the affected partner while others maintain or increase their contributions to cover essentials. The plan should include a defined period for reassessment and a clear path back to the prior arrangement when possible.

How do we handle debt within the group

Discuss debt openly and set boundaries. You may decide that existing debts stay personal or that some minimal debt sharing occurs if the debt benefits the shared life (for example a joint loan for housing). The important part is to document decisions clearly and revisit them if new debts arise.

What about personal expenses and discretionary spending

Discretionary spending should be defined within a personal budget over which each partner has autonomy. Create a discretionary fund with a cap and a quick approval process to avoid budget creep that can erode trust.

How often should we review the budget

Monthly reviews for a year and then quarterly after the system stabilizes work well for many groups. The goal is to catch changes early and keep the plan aligned with life goals rather than letting minor issues accumulate into bigger problems.

Can a new partner join without disrupting the plan

Yes. Introduce a probation or trial period where you test the fit of the new partner with both the group dynamic and the financial plan. If everyone agrees after the trial period the new partner can be integrated into the budget with clear baseline contributions and a timeline for adjustments as needed.

How should we document and share the budget

Use a shared spreadsheet or a budgeting app that allows read and write access to all active partners. Label every line item clearly for example Shared Rent Groceries Utilities and Travel. Attach receipts and notes where helpful so everyone can see how money is being spent and why.

What if someone loses trust in the budgeting process

Address concerns openly and invite the partner to share what feels off. Revisit the assumptions behind the budget and consider a short term freeze on major changes while you work through the issue. Restoring trust often means extra transparency extra communication and more predictable routines.

Love is infinite, but your calendar is brutally finite. The fantasy is deep connection; the reality is often just exhausted "calendar tetris." Promising time you don't actually have isn't romantic, it’s a recipe for burnout and broken trust. That sinking feeling when you have to cancel again? That’s the sound of overextension destroying your relationships.

This calculator forces you to confront the math of your life. Do you actually have space for another heart, or are you just setting everyone up for disappointment?

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.

The ideal is pure equality. The reality? It often slides into hidden rankings where someone gets hurt. That sinking feeling that you are secretly a "secondary" despite the label? That is your intuition detecting couple privilege. Ambiguity is where resentment thrives.

The Essential Guide replaces vague promises with concrete governance. We provide the charters, equity tools, and jealousy protocols needed to ensure "non-hierarchical" isn't just a fantasy. Stop guessing who matters most. Build a network that is actually fair.

The fantasy is total autonomy and connection. The reality? It can feel like drowning in scheduling chaos and misunderstood expectations. That anxiety you feel isn’t just stress; it’s the wobble of living without a default "anchor." Without a solid architecture, Solo Polyamory stops being a life design and starts being a recipe for burnout and confusion.

The Essential Guide replaces the drift with a concrete anchor. We provide the "Solo Ethic," boundary scripts, and burnout protocols needed to protect your peace. Don't just date around—build a life that actually works for you.

Hierarchy sounds like a corporate org chart until someone gets their feelings hurt. That stomach-turning fear that you are just a "secondary" who can be fired at any time is real. If your relationship feels like a secret ranking system, you are doing it wrong.

Ambiguity is where resentment grows. The Essential Guide replaces the "who matters more" panic with a concrete charter. We provide the scripts and equity guardrails needed to protect every heart in the polycule. Stop guessing and start building.